The Single Strategy To Use For Insurance Brokerage

Think it or otherwise, insurer, insurance coverage representatives and insurance policy brokers aren't the same point. If this is news to you, don't worry misunderstandings regarding the distinctions between these 3 insurance coverage service providers prevail amongst consumers. If you're browsing for an insurance coverage company, discovering the distinctions between firms, representatives and also brokers is vital to ensuring you locate the finest insurance coverage remedy for your situation.

— Cloud read the article Links Website (@ldcloudlinks) December 20, 2022

When an insurance firm has an excess of funds from premiums, it will securely invest this money to generate revenue. What is the distinction between an insurance company and an agency?

The Ultimate Guide To Insurance Brokerage

Insurer are carriers of the product, while agencies are companies of the solution, dispersing the product to consumers. What are the pros as well as cons of an insurance policy firm? The following is among one of the most significant pros of selecting an insurer as your provider: Straight provider: An insurance provider is the provider of an insurance coverage policy.

The cons of picking an insurance provider as your supplier consist of: Impersonal service: You will not obtain the customized solution from an insurer that you can get from a representative or broker. If you wish to work with somebody who takes your unique requirements right into consideration, you might desire to collaborate with a representative or broker instead.

All about Insurance Brokerage

What do insurance coverage representatives do? Historically, these representatives represent an insurer or numerous insurer to the general public. A representative gives insurance coverage buyers with details concerning the items and also options used by firms. As an insurance policy purchaser, you can then choose from the policies and also alternatives offered to you through your agent.

Independent representatives can contrast policies from a number of providers to find the most effective terms as well as choices for you. What is the difference between an insurance policy agent as well as a broker? While both representatives as well as brokers collaborate with insurance provider as well as insurance coverage purchasers, they vary in that they represent throughout the acquiring procedure (Insurance Brokerage).

Facts About Insurance Brokerage Revealed

What are the advantages and disadvantages of an insurance coverage agency? Why use an independent insurance policy representative? The advantages of choosing an insurance policy representative include: Personalized focus: You'll get even more personalized service from a firm because they're smaller sized than an insurer. Better plan options: When you deal with an independent representative, they can contrast various insurer to find you the most effective plan.

While a representative stands for insurer, brokers stand for the consumers. Since brokers don't stand for business, they can offer honest referrals to their customers. Insurance Brokerage. What are the pros as well as cons of an insurance broker? The pros of selecting a broker as your insurance policy service provider are that they: Act in the customer's ideal passion: Solution from a broker is personalized and straightforward.

The Buzz on Insurance Brokerage

Quality differs per brokerage firm: Not every insurance broker provides the same high quality of service, so you may intend to search prior to picking to deal with a brokerage firm. Maintain in mind the benefits and drawbacks of collaborating with an insurance policy broker when picking an insurance service provider. Gunn-Mowery offers the most effective of both worlds as both an insurance agency as well as an insurance broker. Insurance Brokerage.

An insurance policy broker is an individual from whom you can get insurance. Brokers offer insurance policy, however they don't help insurance provider. Instead, they shop around to multiple insurance policy companies in support of their customers. Some brokers function independently, others work with each other in broker agent firms. The major job of an insurance coverage broker is to find their clients the very best insurance coverage at the very best price.

Insurance Brokerage - The Facts

Brokers collaborate with multiple insurance coverage companiessometimes dozensso they have quite a couple of choices. When the broker determines the appropriate insurance plan and also provider, they offer the quote to their customer who can choose to buy or not to get. If the customer acquires, the insurance company will pay the broker a payment.

In support of their customers, brokers assist coordinate premium payments, request plan adjustments, and also make suggestions come revival time. Some brokers offer assistance with the claims procedure, though the real case still has actually to be made straight with the insurance policy company. Brokers make payment on the policies that they market.

The Only Guide to Insurance Brokerage

The compensation is based on the premium quantity and also can be as high as 20%, depending on the kind of insurance coverage. Some brokers also charge a brokerage firm fee, which is paid by the customer, rather than the insurance business.

Representatives and also brokers are typically puzzled for each various other. From the outside, they don't seem to be all that different; they both market insurance. The difference is that an representative represents an insurance policy business (or often multiple insurance coverage business), and just offers that firm's plans to customers. Brokers don't help insurance policy firms.

Fascination About Insurance Brokerage

It might appear like brokers are the best method to acquire insurance coverage, yet many individuals choose to deal directly with the insurance policy provider. Acquiring directly from a representative is commonly quicker, since representatives can frequently issue brand-new policies within mins. Brokers need to file an application with the insurer by email or fax as well as wait for it the insurance provider to authorize it.

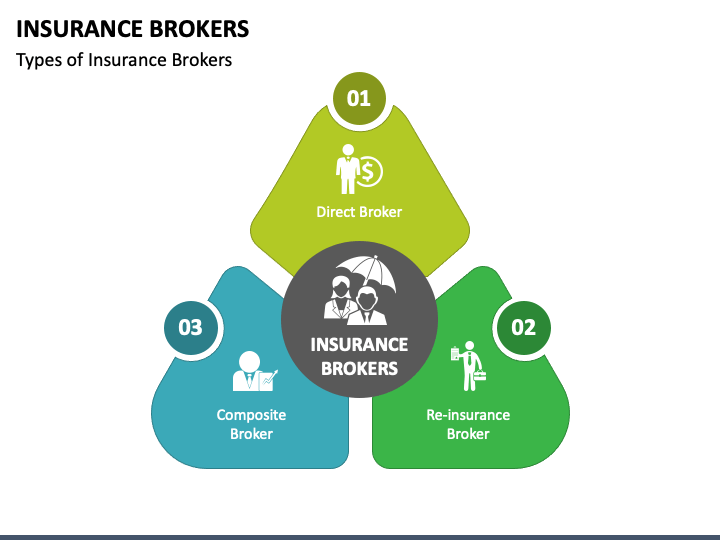

Some insurance brokers provide insurance claims advice services. Insurance brokers are different from agents.

What Does Insurance Brokerage Mean?

Insurance brokers are independent; they do not function for insurance business., residence to loads of easy-to-follow definitions for the most typical insurance coverage terms.

Comments on “The smart Trick of Insurance Brokerage That Nobody is Discussing”